Setting up a company in Seychelles is one of the best ways of investing in the insular state. Thanks to its favorable taxation system when it comes to opening an offshore company, Seychelles attracts many foreign entrepreneurs interested in developing various activities. It is also possible to register onshore companies for trading purposes in Seychelles, case in which one of the important incorporation steps refers to value added tax (VAT) registration.

Below, our company formation agents in Seychelles explain the main provisions related to the value added tax. We can help you open a company and register it for VAT in Seychelles.

The VAT in Seychelles

The value added tax is an indirect or consumption tax imposed on the sale of goods and services by companies in Seychelles. The VAT falls under the regulations of the Value Added Tax of 2010 which entered into effect in 2013. The VAT replaced the former Goods and Services Tax (GST). The current rate of the VAT is 15%.

In order to levy the VAT, a local company must first register with the Seychelles Revenue Commission. Foreign companies with operation here can also apply for VAT registration in Seychelles. Please know that not all products are liable to the payment of VAT.

It must also be noted that the VAT is not applied for non-foodstuffs, such as education services, healthcare, musical instruments, petroleum oils, energy saving bulbs and others.

VAT registration requirements in Seychelles in 2024

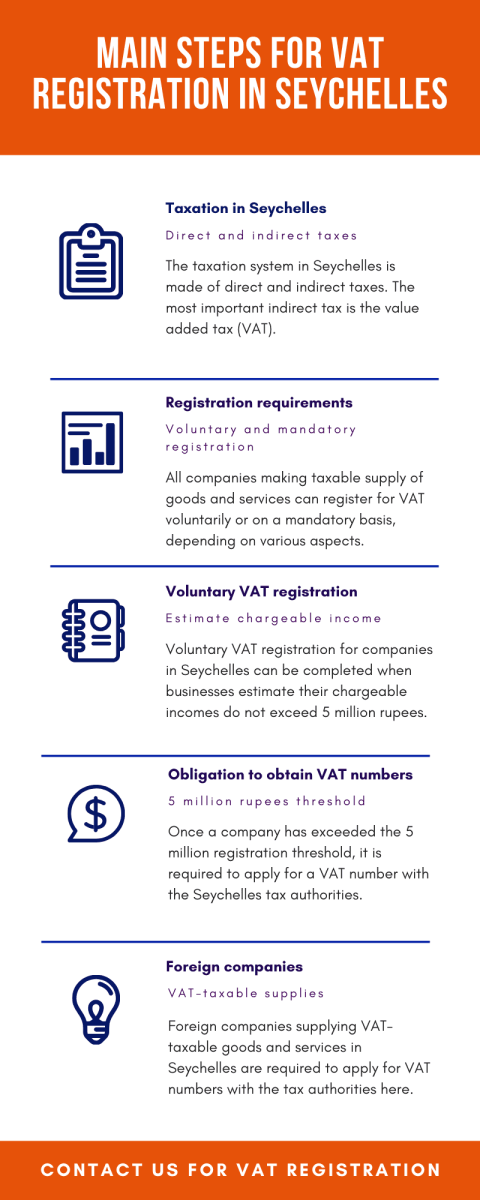

Even if VAT registration is not mandatory when a business is first incorporated in Seychelles, there are situations when it becomes an obligation for both local and non-resident company. In order to understand how VAT registration for non-resident companies in Seychelles works, it should be noted that a business is considered non-resident when its legal seat is not in this country.

In 2024, the obligation to register for VAT in Seychelles for both resident and non-resident companies refers to:

- companies making taxable supplies which are not exempt from the value added tax;

- companies expecting to make yearly sales exceeding the VAT registration threshold which is set at SRC 5 million;

- non-resident businesses supplying goods and services to customers located in Seychelles;

- non-resident companies reaching the annual sales threshold which requires VAT registration.

Both resident and non-resident companies can also register for VAT in Seychelles voluntarily.

Our company registration specialists in Seychelles can help business owners obtain VAT numbers for their resident or non-resident entities in accordance with the local regulations.

You can read about VAT registration in Seychelles in the scheme below:

Non-resident companies registering for VAT in Seychelles

Foreign companies supplying VAT-taxable goods and services in Seychelles, as well as those, with permanent establishments here are required to appoint a VAT representative. The person must be a Seychelles resident. In certain cases, the Revenue Commission can require foreign companies to deposit securities upon the registration for the value added tax.

Our Seychelles company formation advisors can offer more information about these additional requirements for VAT registration. We can also act as VAT representatives on behalf of non-resident companies.

You can also rely on us if you plan on setting up an offshore company in Seychelles.

A Seychelles offshore company can provide many advantages to foreign businessmen, many of them referring to the low tax requirements. The company can be founded by minimum 1 shareholder of any nationality or residency.

It is necessary to appoint 1 director and to register the company’s business address in Seychelles. The capital requirements are also very low – one can incorporate a legal entity with $1.

Very favorable tax advantages can be obtained through the Seychelles IBC, a company that can be set up for developing general business activities.

This entity can benefit from a full tax exemption on the corporate tax or any other tax concerning the income of the business. However, the company must meet certain requirements in order to benefit from this exemption.

Documents for VAT registration in Seychelles in 2024

The following documents are required to legal entities and sole proprietors when registering for VAT in Seychelles in 2024:

- the National Identification Number for sole traders and members in partnerships registered in Seychelles;

- copies of the business license;

- information about the tax representative (where one was appointed);

- copy of the registration documents (depending on the type of entity);

- a list of employees (where applicable);

- the standard application form issued by the Revenue Commission.

The application form is named VAT Registration Form and it must be submitted to the Seychelles Revenue Commission and those who need to register must provide details on the company’s business name, its tax identification number, the company’s registered address, the phone number and an e-mail address.

The form also contains several questions regarding the types of goods or services sold by the company (in the sense that they are taxed with the VAT or not) and about the current turnover threshold and the estimated threshold for the next financial year. VAT formalities slightly differ based on whether the company needs to make compulsory registration formalities or voluntary (they have different VAT obligation formalities – for the first, on a monthly basis, and for the latter, on a quarterly basis).

For new companies, tax registration is first required. During this stage, the National Tax Identification Number is issued. Then, the VAT registration certificate will be issued.

The VAT registration certificate is issued within 1 week after filing the requested paperwork.

Our local representatives can help you prepare all the documents necessary for VAT registration in Seychelles.

We can also help investors who want to open bank accounts in Seychelles.

VAT-related obligations in Seychelles

Once a Seychelles VAT number has been issued, the company or entity obtaining it will have specific obligations. Among these, the collection of the value added tax, the preparation of the VAT returns and their filing in accordance with the terms imposed by the Revenue Commission.

In order to claim VAT refunds in Seychelles:

- a business must have as a main activity the export of goods (at least 85% of its total VAT-related turnover must be made of exports);

- the company must have a VAT credit reported on a monthly or quarterly return of at least SRC 10,000 for 3 consecutive months;

- the VAT tax returns must be filed no later than 28 days after the supply was made;

- the refund will be processed within 45 days after the return was filed.

In 2024, the Seychelles VAT registration procedure has not suffered any modifications, however, it should be noted that traders failing to register for the tax upon meeting the compulsory requirements can be subject to penalties.

For assistance in VAT registration in Seychelles, please contact us.